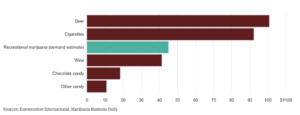

While their industry remains illegal on a federal level, many marijuana growers and retailers fear something completely different: Big Tobacco. Large tobacco companies have garnered expertise in lobbying, marketing, and manufacturing that have huge implications for competition within the cannabis industry. With estimated total revenue of $45B Cannabis sales are above both wine and chocolate consumption. Bloomberg Intelligence analyst, Ken Shea spoke of this as “an extremely compelling opportunity for the tobacco companies to look at closely.”

Chart from Bloomberg Intelligence

Big Tobacco Eyes Green

Tobacco companies have had longstanding interest in entering the cannabis space themselves. In their research investigation paper, Waiting for the Opportune Moment: The Tobacco Industry and Marijuana Legalization, they mention, “Since at least the 1970s, tobacco companies have been interested in marijuana and marijuana legalization as both a potential and a rival product,” researchers Rachel Ann Barry, Heikki Hiilamo and Stanton Glantz wrote in a June 2014 paper published in the Milbank Quarterly. This team from University of Helsinki, UC San Francisco, and the Center for Tobacco Control Research and Education uncovered previously secret tobacco industry topics to examine the long standing interest in cannabis as public opinion has shifted towards legalization.

Cannabis Consumption is Growing

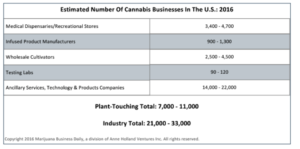

Tobacco consumption is getting smaller while Cannabis is on the rise. In the 1980’s there were 180,000 tobacco-growing operations down to just 10,000 in 2012 according to a census from the USDA. Meanwhile, MJ Biz Daily estimates that there were between 2,500 and 4,500 whole sale cultivators in 2016. Their 2016 Marijuana Business Factbook showed that at large, there were between 7,000 and 11,000 plant-touching businesses and up to 33,000 companies including ancillary services like labs, infused product manufacturers, and technology services. They also estimate that recreational cannabis sales figures are between 40 and $45 Billion per year and only looking to grow even higher.

Source: MJ Biz Daily 2016 Factbook Executive Summary

The Joke’s on Us

Tobacco companies are starting to directly communicate about cannabis. In 2016 for April Fool’s Day, Phillip Morris launched the website, Abril Uno (April 1st in Spanish) to announce their introduction of Marlboro M, their fictitious line of marijuana cigarettes. In all seriousness, this public demonstration shows how big tobacco companies are showing they are near the green light on entering the cannabis space.

Tobacco companies are starting to directly communicate about cannabis. In 2016 for April Fool’s Day, Phillip Morris launched the website, Abril Uno (April 1st in Spanish) to announce their introduction of Marlboro M, their fictitious line of marijuana cigarettes. In all seriousness, this public demonstration shows how big tobacco companies are showing they are near the green light on entering the cannabis space.

Newfound Interest in Cannabis

Beyond jokes, PMI has actually started entering the marijuana space. They invested $20 million in Syqe Medical, an Israeli Cannabis tech company. Their flagship product is a cannabis inhaler that is known for precise dosing. The Syqe inhaler has been in use at an israeli hospital since 2015. Haifa’s Rambam Hospital has been prescribing cannabis for patients there with approval from the Israeli Health Ministry. They also notably have an exclusive marketing and distribution deal with Teva, a global pharma company. This multi-million dollar investment shows Big Tobacco’s strong interest in joining the Green Rush.

An investigation from Cannabiz Journal outlined how Philip Morris Products SA, a subsidiary of PMI based in Switzerland, holds a patent for improving GMO systems for growing Marijuana. Patent US20080281135A1 outlines a creation of GMO plants that yield higher terpenoid production. This patent proves that they are actively researching and looking at marijuana production.

Imperial Brands, another global tobacco company may also be looking to enter the cannabis market. They newly appointed Simon Langelier as a member of its board of directors on June 12, 2017. Langelier is also the chairman of a company called PharmaCielo, a Canadian medicinal cannabis oil (and related products) supplier.

Imperial also has recently changed their name from Imperial Tobacco to Imperial Brands. Without tobacco in their name, they could possibly sell marijuana as well. The name change shows diversification in their product set including their vaporizer line but this could also mean a possible eventual entry into the cannabis marketplace.

The Future is Green

As more research is coming out, consumers are becoming more weary of tobacco and less so of marijuana. Market trends show that cannabis for medical and recreational use has a strong interest and consumers and changing their perspectives and behaviors. Big tobacco wants to be the one that provides stress relief, relaxation, and joy to people in a way that fits in with market trends and consumer demands. They recognize that technology is advancing and are already actively developing cannabis consumption technologies and aggressively entering the vaporizer marketplace.