One of our clients recently had a situation where one of their four SKU’s was not performing as projected, so they were forced to pivot and replaced that strain with a new one. The challenge was that they set out to do things right and had pre-printed the strain names on all of their 4 branded cartridges.

In this mock case study, based on a real-life situation we compare the financial exposure of standard hardware vs. HaloSystem compatible cartridges. Obviously, the names of the brand and its products have been changed “to protect the innocent”, also our client has mandated it.

The Set Up

Alpha Cannabis Co. has decided to enter the vaping market. After spending some time researching various types of vaping products, they settled on live resin and have decided on 3 top SKUs but are still considering a 4th for which they are having mixed feelings but would want to roll out down the road.

These SKUs are:

- Gorilla Paste

- White Rhino

- Sweet Diesel

- OG Dush

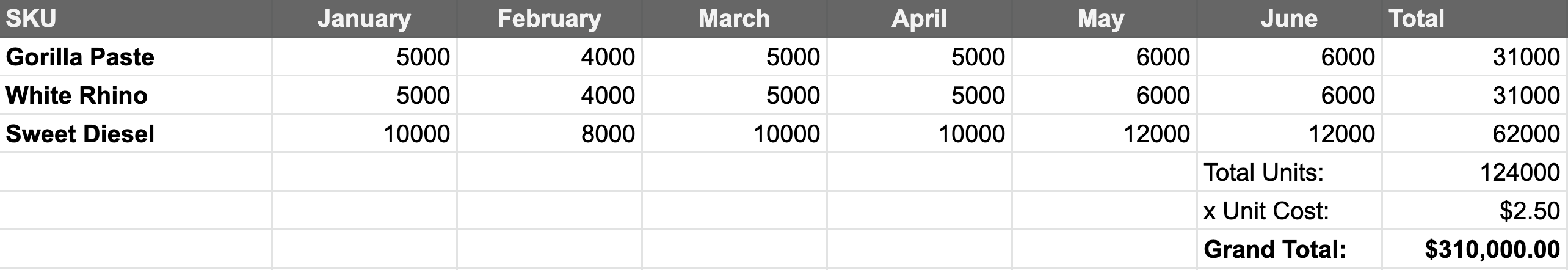

Their marketing and sales teams have crafted a launch strategy for which they are very confident. They have put together monthly sales projections for their finance department to model out their procurement strategy for vaping hardware. Here are the projections they have come up with for the first half of the year:

Projections

Actual Sales Data

Of course, each cartridge has to contain the Universal THC Symbol on the glass, the Alpha Cannabis Co. logo on the cartridge base, and the strain name on the mouthpiece trim ring. Now, for simplicity reasons, let’s imagine that each empty branded cartridge costs $2.50 landed. Of course, some manufacturers will treat each SKU individually depending on the MOQ, but we’ll assume that isn’t the case here.

Also, let’s not forget that custom hardware like this (THC symbol, logos, colors, etc…) take between 4-8 weeks to manufacture. This is the main reason why Alpha has decided to purchase for 6 months, notwithstanding the 100k pcs total order to get the price break.

That’s a total of $310,000 for the hardware for 6 months that Alpha has to plan for, solely based on “projected” sales by the sales and marketing teams. Their CFO and purchasing team agree to placing the order but are really crossing their fingers for these projections to become reality.

Products Hit the Market

Since this launch has been very well planned, all 3 SKUS hit the market on time during the first week of January and the promotional teams are out there pushing sales and messaging around the brand and quality of the products.

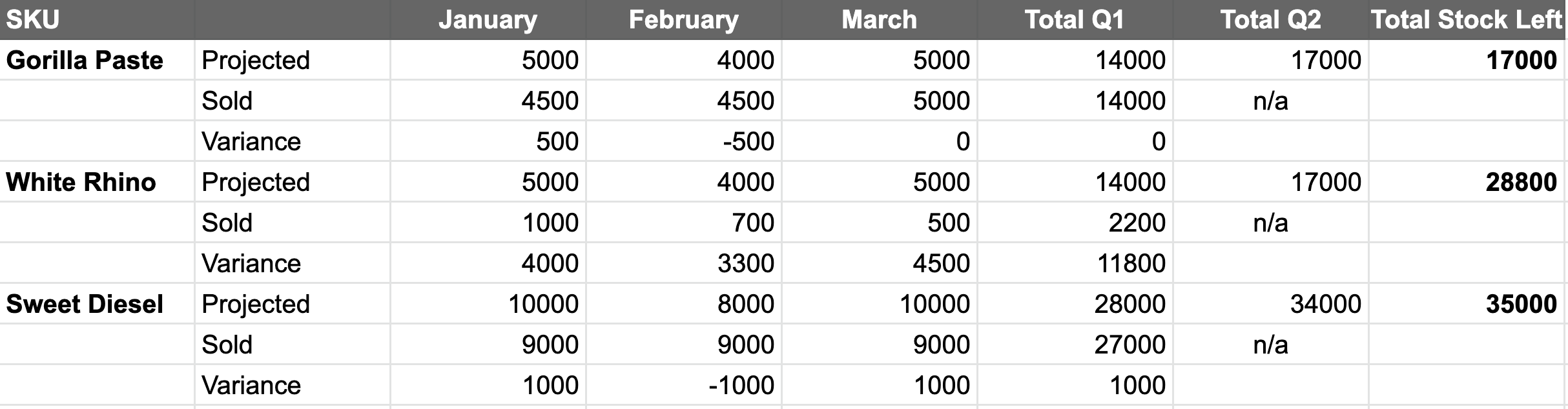

Come the end of the first month, management gets together to reviews sales, they see that:

1. Gorilla Paste is on track with projections and will potentially outsell them

2. White Rhino sales are very low at only 20% of projections

3. Sweet Diesel is perfectly on par with projections

Though sales are doing pretty well and their edibles are making up for low sales of White Rhino, the Alpha team is concerned that if White Rhino doesn’t pick up, they’ll have to pivot but expose themselves to a CAPEX loss over the customized hardware for that SKU.

First Quarter Review: Alpha Vapes

Management has been very busy with acquisitions and rolling out new products as well as expanding their retailer network. They decide that it’s time to review KPIs about their vaping product sales as the CFO has alerted them about some issues.

The sales and marketing team presents them with the following data:

A quick analysis shows Gorilla Paste and Sweet Diesel are on par with projections but are both selling out and fast. On the other hand, White Rhino is completely underperforming. The marketing team has come up with a few reasons: competition for that strain and the lack of an original terpene profile are the main ones.

Their recommendations are:

- Increase production of Gorilla Paste (10k extra carts for Q2) and Sweet Diesel (10k extra carts for Q2)

- Discontinue White Rhino

- Slowly test and launch OG Dush starting with 6,000 pcs in Q2

The CFO steps in and voices a concern about the remaining inventory of the White Rhino cartridges, it represents 28,800 pcs, that’s $72,000 of pre-printed and customized White Rhino inventory that isn’t going to sell. That’s $72k down the drain.

Additionally, the increase of existing SKUs and the launch of the 4th SKU will require an extra investment of $65,000 (26,000 pcs). And this isn’t even factoring in the 4-6 weeks required for manufacturing the new hardware SKU.

Alpha’s management meeting ends with a sour taste: the sales and marketing teams get dinged for their errors in projections, the production team gets dinged for their White Rhino formulation, and the team has to report the loss and extra expense to their shareholders. The “bill” amounts to $137,000: that’s 44% of the initial order.

As we all know, projecting sales in a nascent industry isn’t easy, and the ability to pivot on the fly is key when launching new products. A paradigm shift is necessary and producers, processors, brands, MSOs, and LPs need to the flexibility to mitigate CAPEX. Enter The HaloSystem.

Alternate Scenario: The HaloSystem

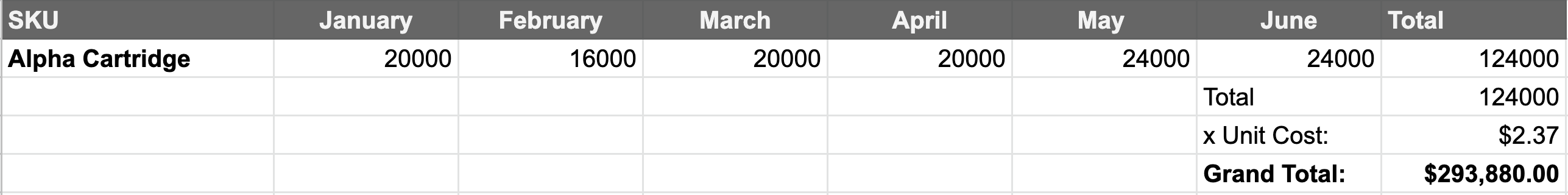

Now, let’s consider the above scenario, with one simple difference. The cartridges Alpha Cannabis Co. ordered initially are HaloSystem compatible.

This means that the base cartridge is identical for every SKU, no matter the customization. Customized TipHalos have been ordered for each SKU. The good thing here is that the Base Cartridge with the brand’s logo stays the same, but the TipHalo is different per each SKU (strain). Here is the same initial order table as above, but adjusted for the HaloSystem:

HaloSystem Compatible Cartridge

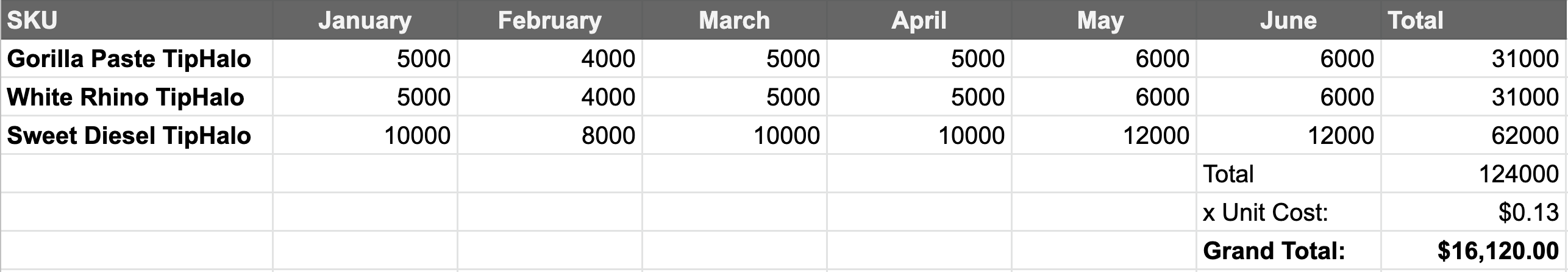

TipHalo

It’s the end of Q1, the management team gets together and listens to the marketing team recommendations, here they are again as a reminder:

- Increase production of Gorilla Paste (10k extra carts for Q2) and Sweet Diesel (10k extra carts for Q2)

- Discontinue White Rhino

- Slowly test and launch OG Dush starting with 6,000 pcs in Q2

The CFO is slowly doing the math on a piece of paper. With the HaloSystem, the cartridge is the same no matter what SKU. Only the TipHalo needs a change: that’s 26,000 new TipHalos at 13 cents each. The CFO is jumping out of his chair shouting “I APPROVE”! The cost of this change in strategy is only $3,380 compared to the $72k that had gone down the drain with pre-printed, strain-specific carts.

The added benefit is that these new TipHalos are delivered in 10 days allowing a much faster pivot for the production team.

Management is satisfied and all teams can move on to spending time on new initiatives and R&D instead of bearing the wrath of, at best, iffy initial projections.

CONCLUSION

Considering same or “as close as makes no difference” pricing of a traditional customized cart vs a HaloSystem cartridge – this switch to how we approach hardware is a no-brainer with a very simple potential to pivot at any time and the added benefit of clearly informing the consumer every time. For those of us who spent more than a month in the industry, the HaloSystem represents a very clear financial and strategic advantage over a traditional cartridge.

#notjustvapor