With millions of marijuana dollars already flowing through US and Canadian stock exchanges, new funds and investors entering the space, and the excitement around the increased legalization of recreational marijuana, we’re seeing a strong appetite among global investors to invest in the US cannabis market.

Despite major exchanges in the US having stringent listing requirements, including revenue and market cap hurdles, we expect to see an increasingly strong pipeline of deals pushing boundaries on major US exchanges in the near future. Three catalysts that could have a real impact on IPO’s are an increasing number of banks welcoming marijuana businesses, the coming legalization in New York and New Jersey, and the growing success of the Canadian public markets:

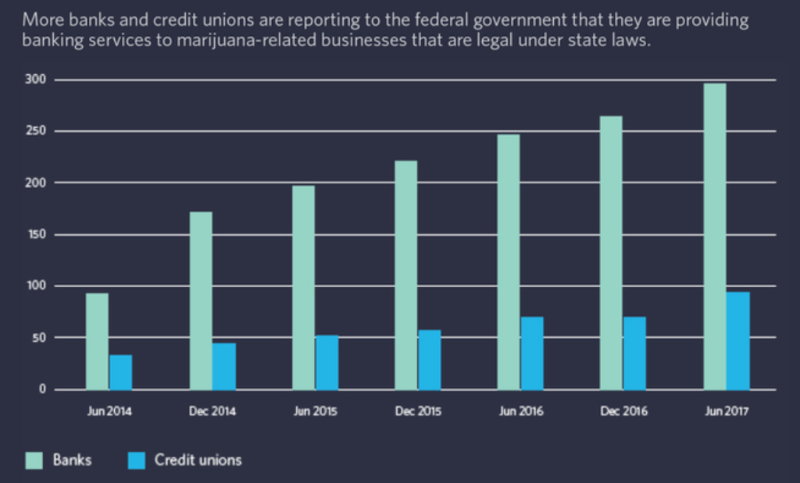

I. More banks are welcoming marijuana businesses:

The number of banks and credit unions that are actively banking the cannabis industry has increased roughly 18% since the beginning of 2017, from 340 to over 400 establishment countrywide. While few institutions and local banks will advertise a willingness to take on marijuana client, many do work quietly with cannabis-related companies.

II. Impending legalization in New Jersey will put pressure on New York:

With recreational marijuana sales set to begin in Massachusetts over the summer and incoming New Jersey governor Phil Murphy poised to legalize pot as quickly as possible, there’s a good chance that hundreds of thousands of New Yorkers will soon be doing a sort of reverse commute – driving or hopping a train out to the suburbs to pick up legal cannabis. New York Governor Andrew Cuomo (D) has recently called for a state-funded study, to be led by the Department of Health, that explores the financial, medical and social impact marijuana legalization will have both on the state and its neighbors. Mr Cuomo has signaled that he is open to the idea of legalizing recreational use of marijuana as a major revenue generator, a notion that will drive an increasing number of IPOs and push the nation to the brink of federal legalization.

III. Canadian public markets competing for US deals:

Stringent regulation and fear of federal intervention in the US make Canadian exchanges look attractive to American cannabis companies. With national legalization coming to Canada this year, the Canadian public markets offer access to a lot of capital, with a lot more certainty and speed than US exchanges. As a growing number of US cannabis companies look to list in Canada, global investors that want to invest in US cannabis are now doing it via Canada. This is the United States’ game to lose.

Bonus: Here are four top cannabis stocks in North America that have reached market caps of at least $2 billion to keep en eye on: MedReleaf Corp., Aphria Inc., Canopy Growth, Aurora Cannabis